Negotiating Away a $23 Billon Default in the 2008 Financial Crisis

In 2008, a global bank asked Flavio Bartmann to solve a problem that threatened a $2.5 billion commercial paper default and a $20 billion credit protection default. Such defaults would further disrupt a financial system already beset with crisis. Executing a solution required difficult negotiations with the bank, commercial paper investors, and credit protection counterparties.

The Request

I got a phone call at 5 am one morning in early 2008 and wondered who was calling me at that hour and what it could be about. It was “Don,” a managing director at “ABC” bank. Don was calling at that hour about a problem ABC was having at a special purpose vehicle ABC had set up to sell credit protection on corporate credit.

- - - - -

Flavio unpacks the phrase “special purpose vehicle set up to sell credit protection on corporate credit.”

In legal structure, a special purpose vehicle (SPV) could be a trust, partnership, LLC, or corporation, depending on tax, legal, and regulatory considerations. SPVs usually invest in a specific and limited set of assets or engage in a specific and limited type of business. The purpose of an SPV is often to isolate credit risk. The most common example of this SPV function is when an asset originator (such as a mortgage company, a credit card issuer, or a commercial bank) sells assets (such as residential mortgages, credit card receivables, or corporate loans) to an SPV.

If done correctly, the SPV’s equity and debt holders are not exposed to the asset originator. Specifically, creditors of a bankrupt originator cannot get at the assets the originator sold to the SPV. Likewise, the originator of the SPV’s assets is not exposed to the SPV. Specifically, the originator is not exposed to the creditors of a bankrupt SPV.

In this case, ABC set up its SPV to “sell credit protection on corporate debt.” This means to agree to pay default losses if a particular corporation fails to make interest and principal payments on its debt. Such credit protection is usually documented as a “credit default swap (CDS).” CDS documentation covers such details as the periodic payments the protection buyer must pay the protection seller, the corporate entity and debt covered by the agreement, the definition of default, coverage tenor, and a mechanism for determining the amount the protection seller must pay the protection buyer in the event of a default.

In summary, ABC set up an SPV to sell credit protection on corporate-issued debt. The SPV sold credit protection by entering into CDS with counterparties buying credit protection. ABC managed the SPV, negotiating the terms of the CDS the SPV entered into. But ABC was not an obligor on the CDS; the SPV was the obligor.

- - - - -

Don told me that ABC’s CEO thought SPV-related losses might equal $250 million and that ABC’s chief risk officer thought that they might have to pay $200 million to get another bank to assume the SPV’s CDS obligations. Don was skeptical of both assertions and wondered if the two executives understood the SPV or its trades. But most of all, Don was anxious not to get involved in a mess that he had nothing to do with. He had deflected the CEO’s and chief risk officer’s request for help by suggesting that ABC turn to me. I said I would try to help and asked Don to send documents that would help me understand the structure of the SPV and the CDS into which it had entered.

The Real Problem

It was only that afternoon after reading the documents Don sent that I realize the magnitude of the problem: the trades were ten times leveraged! The effective exposures were ten times larger than ABC’s CEO and chief risk officer supposed: commercial paper investors in ABC’s SPV were poised to lose $2.5 billion.

ABC’s SPVs had sold credit protection on 12 corporate debt portfolios of 100-125 names totaling $20 billion notional. This meant that in the extreme worst-case default and loss scenario, the SPV would have to make $20 billion of credit protection payments to its counterparties. The SPV’s counterparties, the entities buying the credit protection, were four large global commercial banks and security firms.

The trades had four-to-eight-year maturities. The majority were “super-senior,” meaning the SPV would have to compensate the counterparties if the losses in the corporate debt portfolios exceeded a minimum level, the so-called “attachment point,” which was typically 15%.

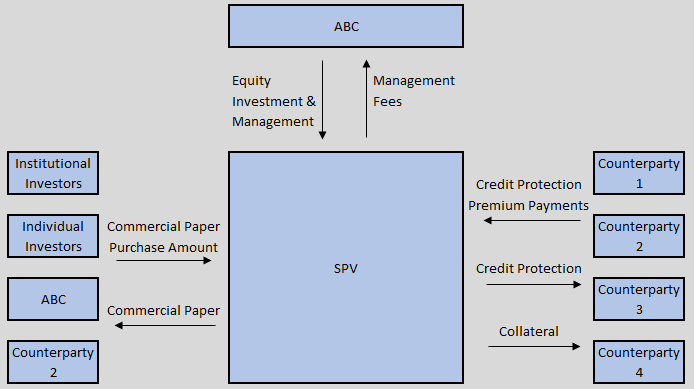

Parties to ABC’s Special Purpose Vehicle

Note: At the top of the exhibit, ABC made an equity investment in the SPV. ABC manages the SPV and receives a fee for doing so. On the right, four counterparties make periodic payments to the SPV in return for credit protection on corporate credit portfolios. The SPV collateralizes its obligation based on the obligations’ market value. On the left, investors, ABC and Counterparty 2 among then, have purchased the SPV’s commercial paper.

But the SPV’s real problem was not the potential payment of $20 billion, which was extremely unlikely. There had been no default losses under the terms of the CDS. Rather, the SPV’s problem was that it was running out of money to collateralize its CDS.

- - - - -

Flavio explains.

The CDS terms required the SPV to post collateral to the counterparties equal to the CDS’s mark-to-market. CDS mark-to-market is a function of credit spreads; for example, the yield above LIBOR of the corporate debt referenced by the CDS. At inception, CDS usually has zero or near-zero market value. In a sense, zero market value implies that the certain payments the protection buyer pays the protection seller equal the probability-weighted default payments the protection seller might have to make to the protection buyer. But as the referenced debt’s credit spread changes, the CDS’s mark-to-market changes.

At this time in early 2008, at the beginning of the so-called Great Recession, corporate credit spreads over LIBOR had widened substantially, even for triple-A rated debt deemed extremely unlikely to default. Higher credit spreads on referenced corporate debt move the mark in favor of the protection buyer. The idea is that higher credit spreads mean the referenced debt is getting riskier, default is more likely, a payment to the protection buyer is more likely, and the CDS is becoming more valuable to the protection buyer. A further wrinkle was that the SPV’s counterparties were the calculation agent on their CDS, meaning that the counterparties determined the CDS mark and therefore the SPV’s collateral obligation.

- - - - -

The CDS mark-to-market had moved massively against the SPV, to the point where the SPV had posted nearly $2.5 billion of collateral to the four counterparties to which it had sold credit protection. But the mark-to-market had moved still further in the counterparties’ favor and the counterparties were demanding nearly $2 billion more collateral. The SPV did not have the funds to post more collateral.

The SPV was designed to continuously issue $2.5 billion of commercial paper with 45-day maturities. This $2.5 billion figure was designed to cover the SPV’s credit protection payments. Note that the $2.5 billion could only cover 12.5% of the SPV’s total credit protection exposure of $20 billion. But it was assumed that the chance of the SPV being required to pay more than $2.5 billion was minute. In fact, a credit rating agency had given the SPV a triple-A rating on its ability to make necessary credit protection payments.

The SPV’s solvency was not being threatened by credit protection payments, but by collateral requirements. It had run out of funds to meet collateral demands. The significance of this is that if the SPV did not post required collateral, its counterparties could terminate the CDS and keep the collateral they already held. Then, the counterparties would have a further claim against the now asset-less SPV for the excess of the CDS’s mark over the amount of posted collateral at the time of termination. This would be disastrous for the SPV’s commercial paper holders, who would receive nothing of the $2.5 billion they had invested.

Nor would ABC be unscathed by a failure of the SPV. Assuming the SPV had been designed properly, ABC had neither the obligation to make collateral or credit protection payments on behalf of the SPV nor the obligation to pay off the SPV’s commercial paper investors. But ABC would endure reputational damage from sponsoring an SPV that failed so spectacularly. ABC would specifically face the wrath of the SPV’s commercial paper investors. And the SPV’s failure would be certain to attract unwanted regulatory scrutiny. ABC was a systemically important global financial institution. As such, a spectacular loss might have world-wide repercussions on financial markets.

The Plan

I devised the following plan, which relied on the goodwill and cooperation of three separate groups involved with ABC’s SPV; each group having its own unique interests. I suggested commercial paper investors waive their rights to timely repayment, essentially turning their investment into long-term debt of up to eight-year maturity.

I also suggested ABC inject $1 billion into the SPV, in the form of an equity investment, so the SPV could post those funds as collateral to the SPV’s counterparties. And I suggested the SPV’s counterparties divide this additional $1 billion of collateral between themselves and not demand any additional collateral owed them under their CDS agreements. Finally, I suggested that ABC forego SPV management fees.

Each group would consider my proposal in light of their economic position and alternatives.

Commercial paper investors did not have much of a choice. They had the right to put the SPV into bankruptcy for non-payment of the commercial paper when due. But that would not have gained them anything. All the SPV’s fungible assets were at the SPV’s counterparties and those counterparties had a higher-seniority claim against the SPV than the unsecured commercial paper holders.

Commercial paper holders might try to force ABC to repay them. They could try to attack the corporate separateness of the SPV from ABC and claim that ABC had an obligation to pay the SPV’s obligations. Commercial paper holders could also attack ABC’s sales practices in selling them commercial paper with such risks; the two individual investors among the commercial paper holders especially. But these legal theories against ABC were highly uncertain to prevail and would take years to litigate.

ABC’s consideration was to its own reputation. Sponsoring an SPV that dealt $2.5 billion of losses to its customers would be a horrible black eye. And if commercial paper investors pursued any of the previously mentioned legal actions against ABC, the issue would remain public and active across years of litigation. This would harm ABC even if ABC ultimately prevailed. As mentioned, the SPV’s failure would be certain to attract regulatory attention to ABC, especially if the SPV’s failure affected confidence in national and global financial markets. But was it worth injecting $1 billion of capital into the SPV to ameliorate these reputational and regulatory risks?

Negotiating with the Parties

The entities with the greatest freedom of action were the SPV’s four counterparties which had bought credit protection from the SPV. They were large institutions, with massive balance sheets, armies of lawyers, and large and experienced trading desks. Any of them could demand the collateral owed them, and if the SPV did not provide it, they could terminate the CDS and keep the collateral they had already received. Then, they could use the collateral to purchase a replacement CDS. More opportunistically, they might not replace the CDS, but instead pocket the collateral and assume the risk on which they had previously bought protection.

This last possibility was an intriguing strategy for the SPV’s counterparties. As mentioned, at the beginning of the Great Recession in 2008, credit spreads had increased dramatically. That was why the mark on the CDS had swung so greatly in the counterparties’ favor and required greater and greater collateralization. But how much had actual credit risk increased? The counterparties had in aggregate $2.5 billion of collateral to absorb losses. If the counterparties terminated the CDS and there were no default losses, that $2.5 billion would be a windfall gain.

The credit expert at my firm, Pam Stumpp, was the perfect person to examine the credit risk of the corporations underlying the CDS. She had 29 years of credit experience as a managing director at Chase Manhattan and as a managing director and chief credit officer for North American corporate finance at Moody’s. Her verdict, after four days and nights of examining the corporations referenced in the CDS, was that the SPV was very unlikely to be required to make default payments. In her opinion, the SPV’s problem was limited to its inability to post required collateral to its counterparties.

Pam made a compelling presentation to ABC, convincing its executives that the SPV would not have to make default payments and making the executives see that the risk-reward balance favored the bank making a $1 billion equity investment in the SPV. As I mentioned, commercial paper investors didn’t really have much of a choice, but ABC’s equity injection of $1 billion in the SPV, below the commercial paper holders in the SPV’s capital structure, provided protection to the commercial paper. The equity injection thus reduced commercial paper holders’ incentive to file the SPV into bankruptcy for non-payment and bring legal action against ABC.

The tricky part was convincing the SPV counterparties to accept a limited amount of additional collateral and forego enforcing their rights against the SPV. If Pam was right and the credit risk of the corporates underlying the CDS was small, the counterparties would reap a windfall by terminating the CDS, keeping the collateral, and not replacing the CDS. It was my job to convince the counterparties to accept my scheme. I approached each of the four counterparties.

Counterparty #1 was a major global securities firm, already suffering significant problems of its own as a result of the financial crisis that brought about the Great Recession. It was going to have to rely on the goodwill of others, including government regulators around the world, to survive. Creating a problem at another financial institution would not endear it to anyone. It needed good karma and agreed to my proposal.

Counterparty #2 was a second-tier bank and securities firm. Instead of signing on to my scheme, its representative wanted to meet me in person to propose a restructuring of its CDS with the SPV. We met on a very cold Saturday morning. Taking off her Winter coat, she wore a short dress with a plunging neckline. I wondered whether she was counting on her pitch book or her dress to convince me.

Her restructuring idea significantly improved her firm’s position relative to the SPV’s other counterparties. None of the other counterparties would agree to my proposal if her firm was so singularly advantaged. Complicating her firm’s position was the fact that besides being a CDS counterparty to the SPV, her firm had also invested in its commercial paper. How her firm’s risk managers assessed the risk of simultaneously buying protection from the SPV and supplying the capital required to support the SPV’s obligation was beyond my comprehension. But the fact that her firm was on both sides of the SPV gave me a good talking point when I contacted her boss. I asked him to carefully consider their position and proposal. I argued that his subordinate’s proposal was unethical and possibly in violation of securities law. Upon reflection, he also agreed to my proposal.

Counterparty #3 was a major global bank and securities firm headquartered in Europe. It refused to accept my proposal, and instead demanded additional collateral. Obviously, they wanted the windfall they thought would occur when they terminated the CDS and kept the collateral they already had. But ABC talked to its home-country central bank, which talked to Counterparty #3’s home-country central bank. Each central bank was trying to keep their respecting economies and financial systems healthy in the midst of the Great Recession and I suppose favors and accommodations had flowed in each direction over the previous year. Apparently, Counterparty #3’s central bank forced it to accept my terms.

Counterparty #4 was a first-tier bank with a second-tier security firm. I finally found the individual now responsible for the position, who was willing to talk to me on the phone at 1:30 am of the day I needed to finalize the restructuring. I could not delay because if I did, the other three counterparties might become skittish and back out. They might worry that the other counterparties would move against the SPV before them and gain some advantage. So, it was critical I wrap the deal up with Counterparty #4 that night.

The individual at Counterparty #4 gave me a list of minor nits on the wording of my term sheet and asked for more time to consider the proposal. I told him that the only thing that mattered was how much extra collateral his firm was going to receive from the $1 billion ABC was putting into the SPV. He admitted to me that several different managements had come and gone in his firm’s credit derivative department since it executed the CDS with the SPV. He felt it was unfair that he had to deal with a situation he had not created and with which he was unfamiliar. He did not like having to make a decision he thought could destroy his career with limited information. Then he began to cry.

I told him the safest thing he could do, career wise, was to go along with the other three counterparties and accept my proposal. The fact that he was doing what three other firms, firms more sophisticated and respected than his, were doing would insulate him from any criticism, whether or not it turned out in the end to be the optimal decision. If he instead went his own way and withheld his firm’s agreement, and that policy turned out to be a disaster, he would have no such defense. Furthermore, his peers at the other firms would hate him and take it out on him any way they could. Would he ever want a job at counterparties one through three? I got his agreement.

The plan worked out. Corporate credit spreads gradually came in and the SPV’s required collateral declined. The SPV never had to make a default payment and the SPV’s commercial paper investors did not lose any money, although they had to wait up to eight years for payment. ABC’s share price increase 13% in the three weeks immediately after the restructuring was announced.

Flavio Bartmann held senior positions at Merrill Lynch from 1988 to 2002, including head of global commodities and head of US fixed income derivatives. In 2006, Flavio founded Pallium Investment Management, a firm that helped institutional investors navigate credit markets. He is Senior Consultant to ISDA on Dodd-Frank Act implementation and a professor at Columbia University and New York University.

To comment on a story or offer a story of your own, email Doug.Lucas@Stories.Finance

Copyright © 2022 Flavio Bartmann. All rights reserved. Used here with permission. Short excerpts may be republished if Stories.Finance is credited or linked.